Your intelligent mortgage platform.

Whether you’re buying a home, selling one, or building a business around both, Realfinity gives you the capital, compliance, and tech to make it happen.

lower cost to originate

hours loan approval turn time

investors available via Realfinity

hires needed to launch

Loans We Support

Flexible loan types to meet you where you are.

Conforming Loans

Reliable financing backed by Fannie Mae and Freddie Mac — ideal for primary, secondary, or investment properties.

FHA, USDA & VA Loans

Government-backed options designed for qualified buyers seeking flexible terms or zero down.

Bank Statement Loans

Perfect for self-employed borrowers — qualify based on income shown through bank deposits, not tax returns.

DSCR Loans

Investor-friendly loans based on rental income, not personal income — ideal for scaling property portfolios.

Jumbo Loans

High-balance financing for luxury or high-value properties that exceed conforming loan limits.

HELOCs & HELOANs

Tap into your home’s equity with flexible credit lines or fixed-rate loans — for renovation, debt consolidation, or major purchases.

Cash-Out Refinance

Unlock your home’s equity with a cash-out — refinance your existing loan and walk away with cash in hand.

The easiest and most profitable way to offer mortgage.

The easiest and most profitable way to offer mortgage.

Grow Your Business

Generate additional mortgage revenue from past and future client relationships.

Streamline Transactions

Embed mortgage and simplify transactions, all while enhancing your client experience.

Build Lasting Relationships

Increase client loyalty, boost trust, and stand out by guiding clients in managing their real estate assets.

Who we work with

Your partner enhancing every part of your mortgage services.

Individuals

All commissions paid via W2. This solution works best for individual contributors.

Loan Officers

For individual contributors who want to focus on origination—not operations.

Real Estate Agents

For agents who want more control, a seamless end-to-end transaction, and higher earnings.

Wealth Advisors

For advisors whose broker-dealers don’t offer mortgage. Add a new revenue stream and strengthen fiduciary alignment.

Companies

All commissions paid 1099 to your entity. This solution works best for start-ups, asset managers or brokerages.

Asset Managers

Unlock more revenue on every disposition. Realfinity embeds mortgage into your sales proces, boosting offer strength and maximizing exit value.

Real Estate Brokerages

A modern alternative to JVs and MSAs. Realfinity delivers a seamless mortgage experience and new revenue streams via in-house loan officers or dual-licensing your agents.

Start-Ups

Monetize your users with embedded mortgage. Realfinity offers scalable, API-first infrastructure to power seamless end-to-end transactions. No legacy baggage, fully embeddable.

Individuals

All commissions paid via W2. This solution works best for individual contributors.

Loan Officers

For individual contributors who want to focus on origination—not operations.

Real Estate Agents

For agents who want more control, a seamless end-to-end transaction, and higher earnings.

Wealth Advisors

For advisors whose broker-dealers don’t offer mortgage. Add a new revenue stream and strengthens fiduciary alignment.

Companies

All commissions paid to your entity. This solution works best for start-ups, asset managers or brokerages.

Asset Managers

Unlock more revenue on every disposition. Realfinity embeds mortgage into your sales process—boosting offer strength and maximizing exit value.

Real Estate Brokerages

A modern alternative to JVs and MSAs. Realfinity delivers a seamless mortgage experience and new revenue streams—via in-house loan officers or dual-licensing your agents.

Start-Ups

Monetize your users with embedded mortgage. Realfinity offers scalable, API-first infrastructure to power seamless end-to-end transactions—no legacy baggage, fully embeddable.

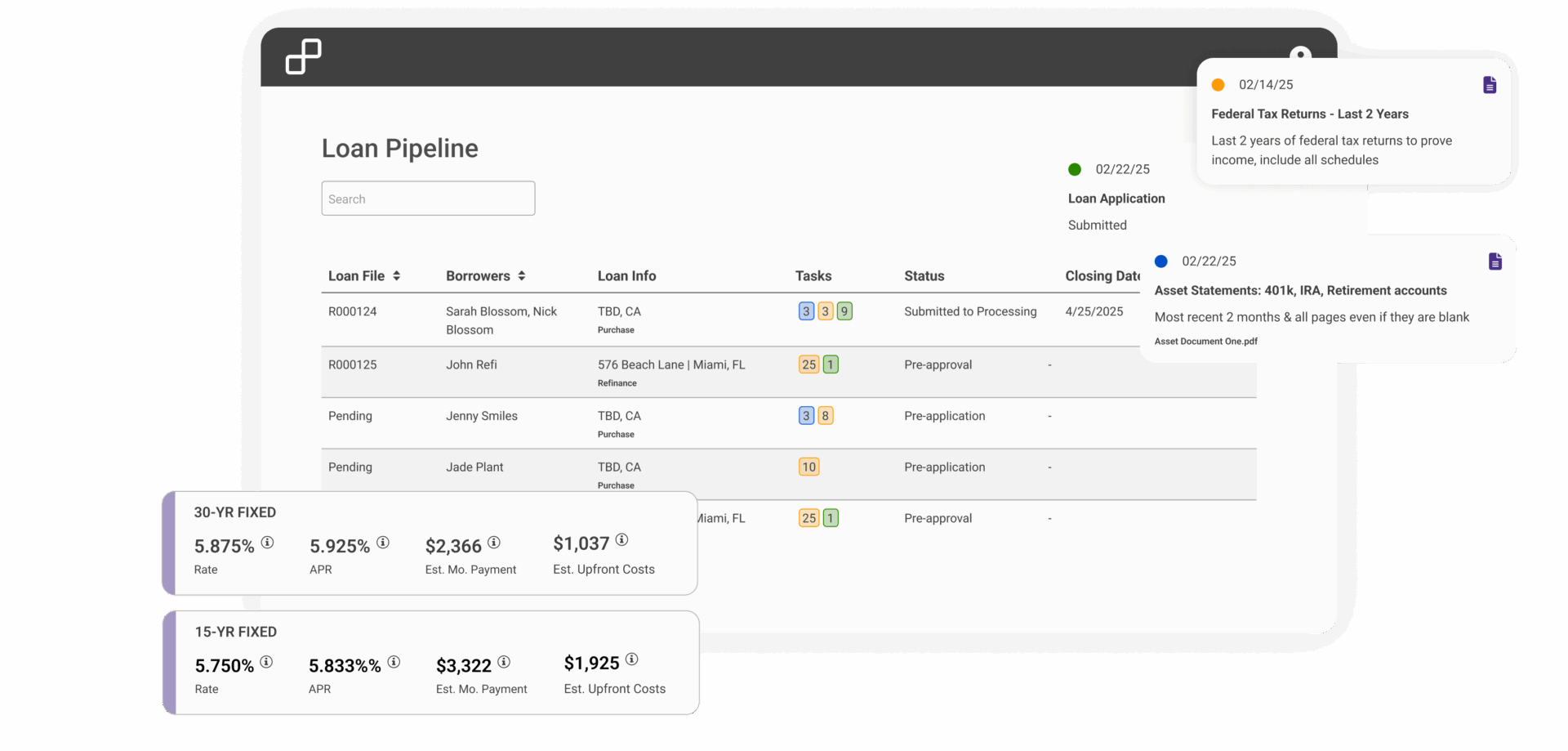

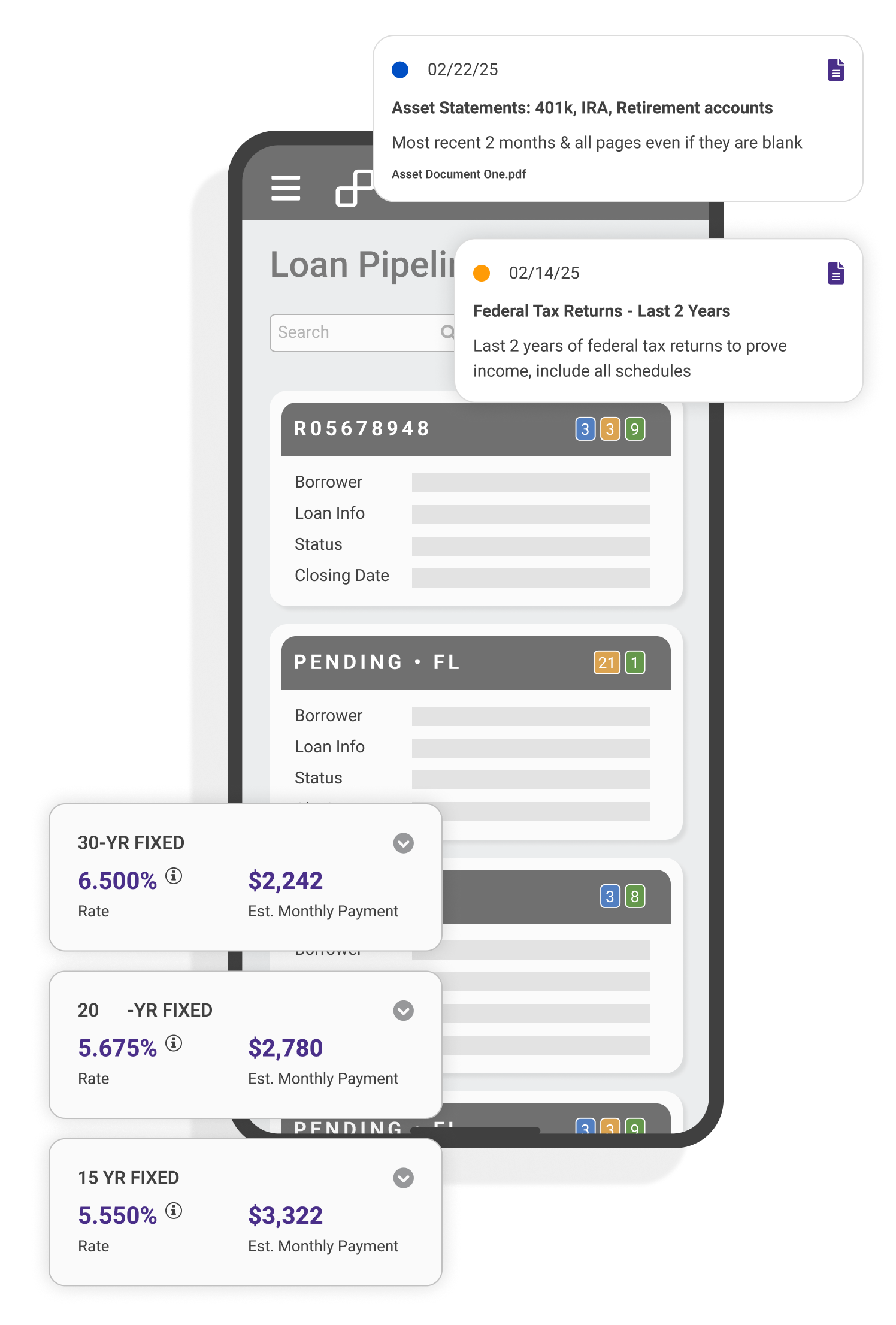

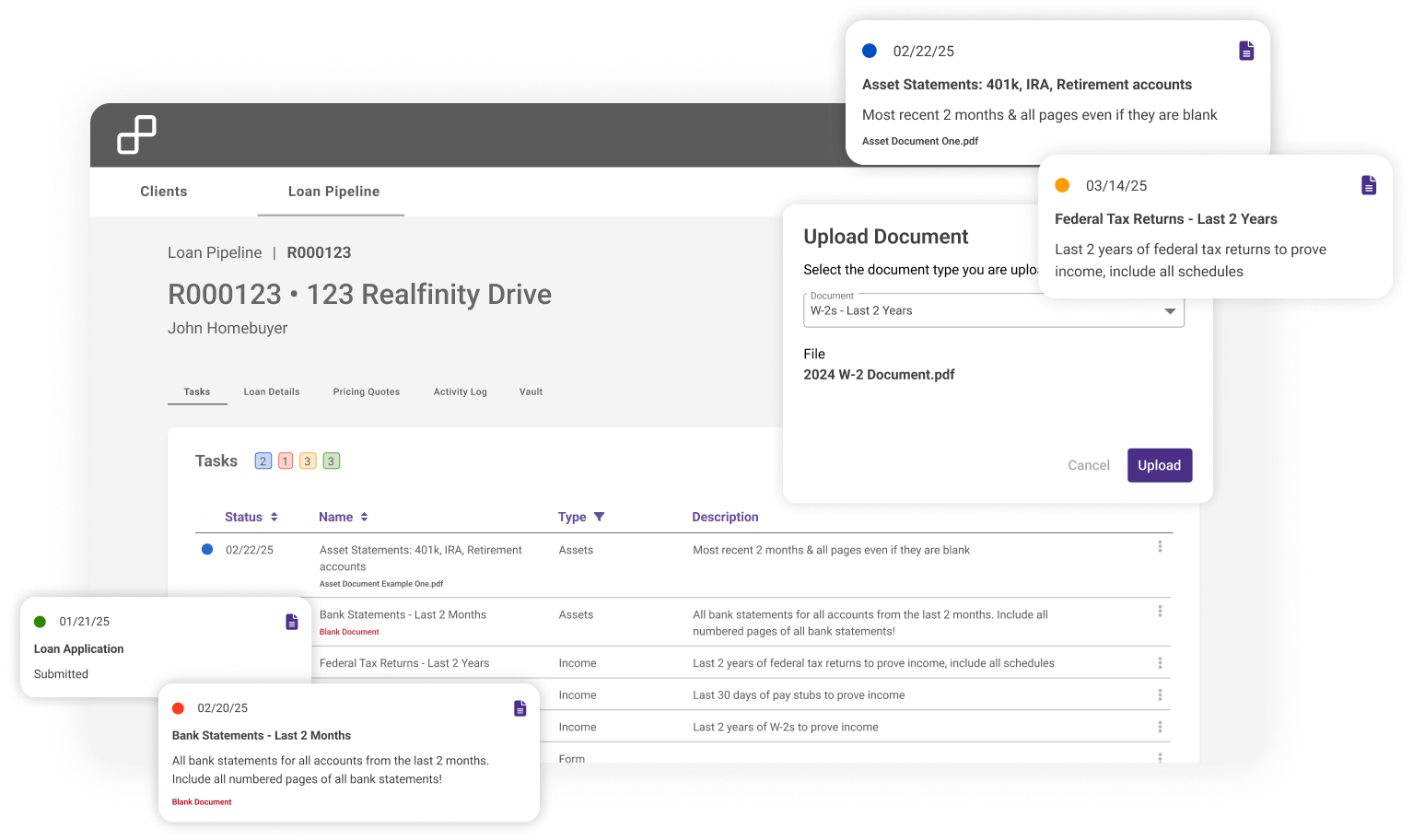

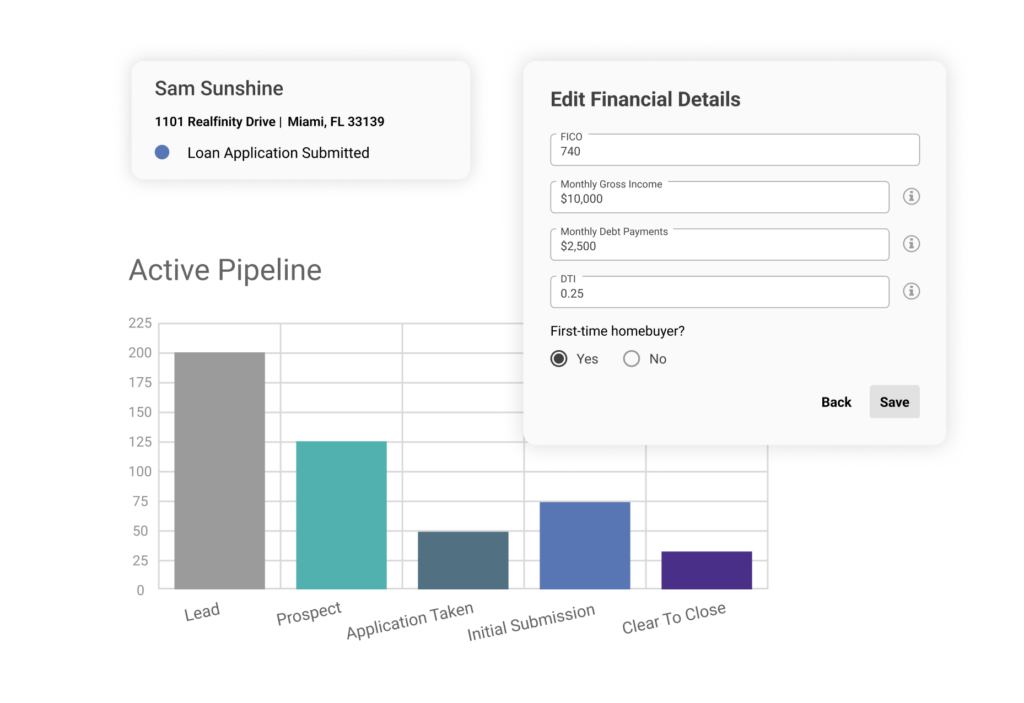

Everything you need to offer mortgage to your clients in one platform.

Doc-First Mortgage Applications

Borrowers begin by uploading key documents and connecting accounts. Our platform validates and auto-fills applications instantly, accelerating decisions and increasing conversion.

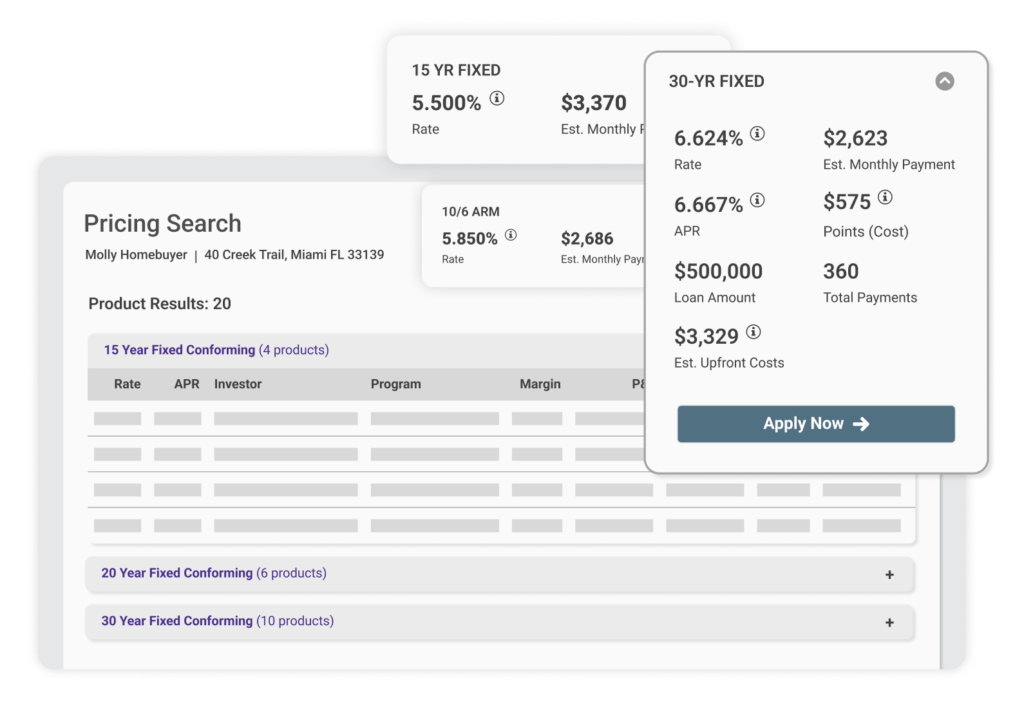

Live Rates, Smarter Quotes

Compare loan products from top investors with real-time pricing. Run scenarios, quote confidently, and win more deals.

AI Approvals and Instant Credit Decisions

Realfinity analyzes credit, income, and assets in real time to deliver fast, accurate decisions. Once approved, we handle the processing – so you stay focused on your client, not the file.

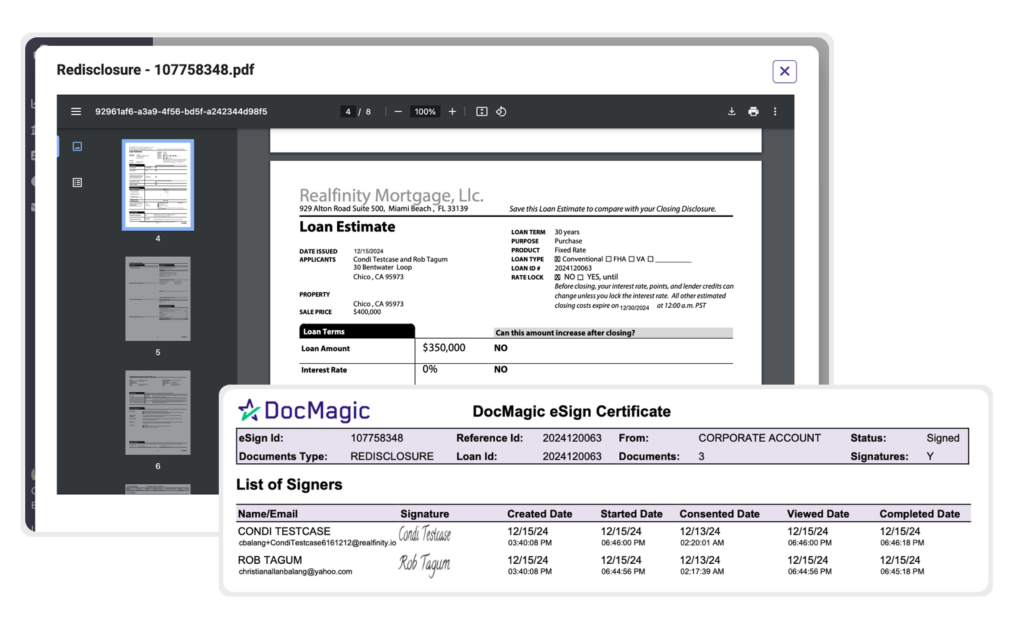

Compliance That Keeps Pace

Loan-level checks run automatically. Disclosures are triggered, tracked, and signed without delay, keeping you compliant and moving forward.